will capital gains tax rate increase in 2021

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Capital gains tax rate 2021 calculator list of stripe.

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

The following are some of the specific exclusions.

. Hundred dollar bills with the words Tax Hikes getty. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund.

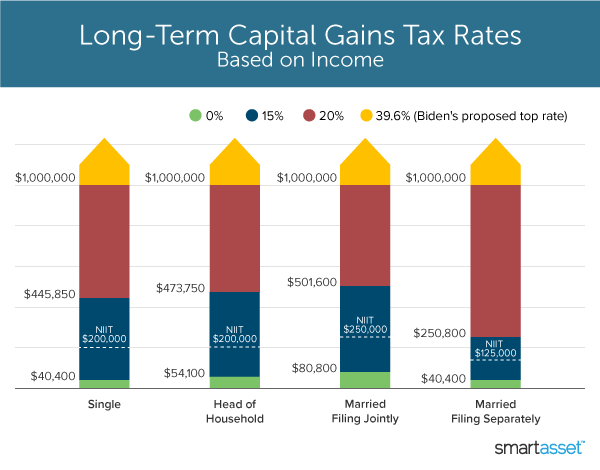

President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee.

Increase Tax Rate on Capital Gains Current Law. The effective date for this increase would be September 13 2021. The Chancellor will announce the next Budget on 3 March 2021.

The proposal would increase the maximum stated capital gain rate from 20 to 25. Imposes a progressive income tax where rates increase with income. How the 0 Rate Works.

There are seven federal income tax rates in 2023. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. For example if you had 900000 in wages and 200000 in long-term capital gains 100000 of the capital gains would be taxed at the current long-term capital gains tax rate.

With average state taxes and a 38 federal surtax. The 238 rate may go to 434 for some. However it was struck down in March 2022.

The Federal Income Tax. Capital Gains Tax. Most realized long-term capital gains.

Special cases for taxation. Events that trigger a disposal include a sale donation exchange loss death and emigration. Its time to increase taxes on capital gains.

Add this to your taxable. Many speculate that he will increase the rates of capital. Capital Gains Tax.

Capital Gains Tax Rate. That rate hike amounts to a staggering 82. Assume the Federal capital gains tax rate in 2026 becomes 28.

In tax year 2021 the 0 tax rate on capital gains applies to married taxpayers who file joint returns with taxable incomes up to 80800 and to single. 2021 Longer-Term Capital Gains Tax Rate Income Thresholds. Note that short-term capital gains taxes are even higher.

The proposal would be effective for taxable years beginning after December 31 2021. 2021 Capital Gains Tax Rates Brackets Long-Term Capital Gains. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase.

The proposed increase would tax long-term gains over 1 million as ordinary income which means that these high-income investors would have to pay a top rate of 396. Here are 10 things to know. Unlike the long-term capital gains tax rate there is no 0.

A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year. For long-term capital gains thats a potential increase of up to 196 over the current.

First deduct the Capital Gains tax-free allowance from your taxable gain. Implications for business owners. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

Capital Gains Tax Hike And More May Come Just After Labor Day

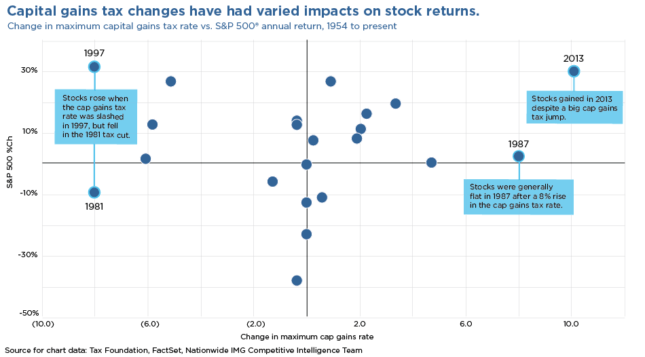

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Concerns Rise Over Tax Increase Proposals Nationwide Financial

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

The Real Question On A Capital Gains Hike Is Whether It S Retroactive

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

State Taxes On Capital Gains Center On Budget And Policy Priorities

What S In Biden S Capital Gains Tax Plan Smartasset

What You Need To Know About Capital Gains Tax

New Tax Initiatives Could Be Unveiled Commerce Trust Company

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Individual Capital Gains And Dividends Taxes Tax Foundation

Capital Gains Taxes And The Impact On The Sale Of Privately Held Companies

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)